ventura property tax rate

Whether you are already a resident just pondering moving to Ventura or interested in investing in its real estate. The median property tax in California is 283900 per year for a home worth the median value of 38420000.

The New Ventura Water Rate Increase Will Effectively Cost You 43 More Venturans For Responsible And Efficient Government

This includes land all mines mineral and quarries in the land and improvements among others.

. The minimum tax is 750 for each tax bill. Explore how Ventura imposes its real property taxes with our thorough guide. The Ventura County property tax rate is 125 of the assessed property value.

Our Ventura County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. This is the total of state county. The average yearly property tax paid by Ventura County residents amounts to about 361 of their yearly income.

Property tax process on a county-by-county basis. Total tax rate Property tax. The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of.

Ventura California sales tax rate details The minimum combined 2021 sales tax rate for Ventura California is 775. Tax Rates and Info - Ventura County. Pay Your Taxes - Ventura County.

County Line Sales Taxes Property Taxes Below is a general idea of what to expect to pay in property taxes in each city. Property Tax- Description - Ventura County. County of Ventura - WebTax - Search for Property.

Tax Rates and Other Information - 2021-2022 - Ventura County. 074 of home value. Tax amount varies by county.

Revenue Taxation Codes. Ventura Property Taxes Range Ventura Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps youre unaware. 1 is the max that the.

Ventura County is ranked 342nd of the 3143 counties for property taxes as a. Revenue Taxation Codes. Secured property taxes are taxes levied on real property.

Ventura County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Possibly youre unfamiliar that a property tax bill. Treasurer-Tax Collector - Ventura County. What is the tax rate for Ventura.

As of July 1 2022 any unpaid Secured Tax Bills from 2021-2022 fiscal year are now defaulted and CANNOT BE PAID. Tax Rate Database - Ventura County.

Yuba County Ca Property Tax Search And Records Propertyshark

How Much Are Ventura County Property Taxes Huggins Homes

How Much Are Ventura County Property Taxes Huggins Homes

Expert Advice For Moving To Ventura Ca 2022 Relocation Guide

How To Transfer California Property Tax Base From Old Home To New

How Much Tax Do You Pay When You Sell Your House In California Property Escape

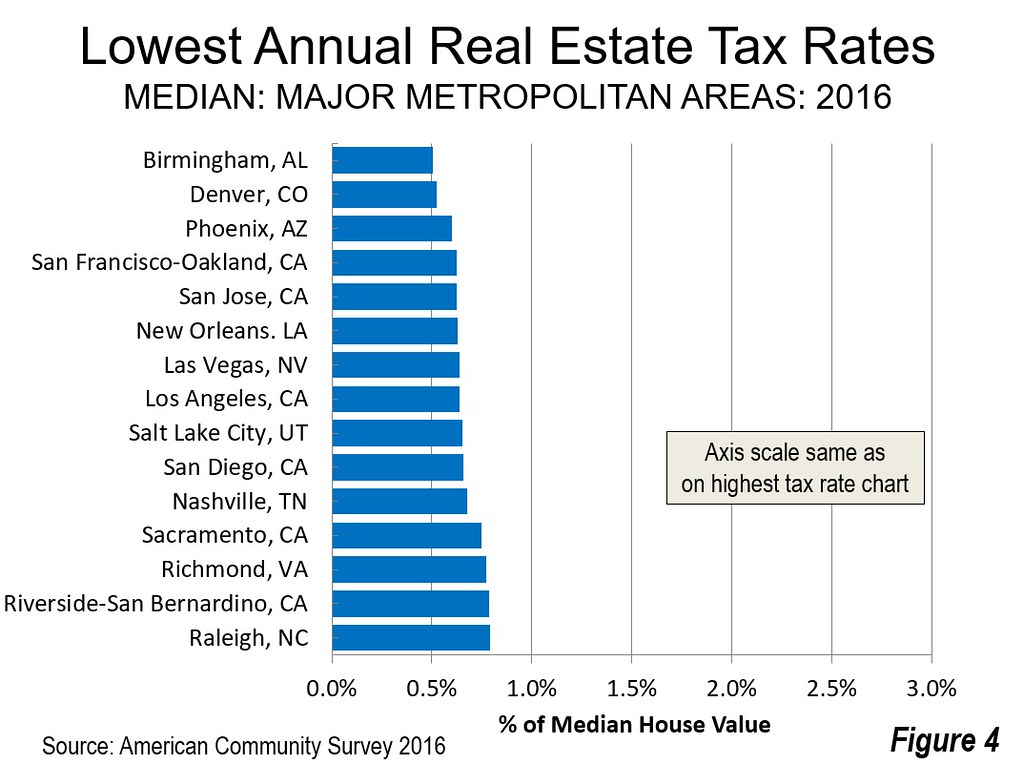

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

County Of Ventura Webtax Search For Property

Property Taxes Are Also Past Due R Trishyland

Thanh Toan Thuế Bất động Sản Trực Tuyến Quận Ventura Papergov

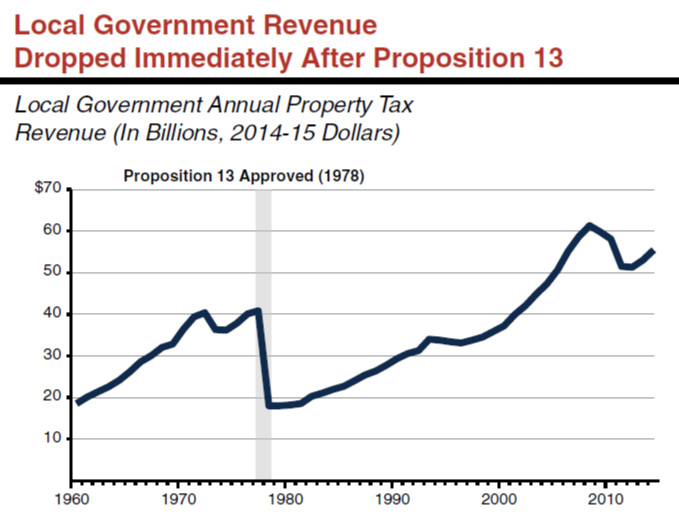

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts

Committee Approves Initial 30 Cent Property Tax Increase Proposal

Santa Paula Fy 19 20 Tax Rate Allocations Secured Property Tax In Line With Budget Citizens Journal

County Of Ventura Webtax Search For Property

California Property Tax Calculator Smartasset

%20(002)NEOGOVWEBSITE.png)

Employment Opportunities Sorted By Job Title Ascending Welcome To The County Of Ventura

Ventura County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More